Money is anything that is universally accepted as a medium of exchange and for settlement of debt. It can also be defined as anything that is generally acceptable as a means of payment. Money includes cash, bank notes, bank drafts, postal orders etc.

Evolution of Money

Before the advent of money, exchange took place by means of barter. This means that goods were exchanged for goods. The ancient people practiced subsistence farming that is they were able to provide for what they need. However, when the need comes for them to get what they do not have, they had to look for someone who want what they have and at the same time would give them what they want. This system of exchange was problematic and so effort was made to resolve the problem.

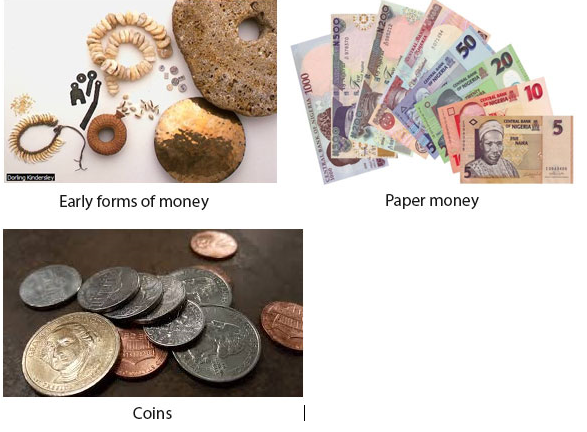

The solution came when items like cowries, cattle, shells, tobacco, salt and beads were used as medium of exchange. This means of exchange had his flaw because of the size and weight of the items used especially when a goat could be exchange for bags of cowries. Later, Precious Metals were weighed out whenever a payment was to be made. With time the metals were cut into pieces of definite weights and so, coins of limited face value were issued. And so, coins of limited face value were issued.

Paper money came to be as a result of the receipts issued by the goldsmiths in exchange for deposits of precious metal. The receipts became bank notes and the goldsmiths became bankers. In modern times, a further advance has been made by way of adopting paper money.

EVALUATION

- Explain the term ‘money’.

- Discuss on the evolution of money.

Functions of Money

(i) Medium of Exchange: Money can be used in exchange for goods and services because it is generally accepted. This means that money facilitate exchange.

(ii) Standard of Deferred Payment: Since money is durable and can be stored, it can be used for settlement of debts. The use of money makes it possible for credit transactions I e goods and services can be paid for at a later date.

(iii) Unit of Account: The true worth of goods and services is measured in monetary terms. This makes accounting possible. It also makes installment payments possible.

(iv) Store of Value: Money is a good store of value because wealth can be stored for future use. When there is no inflation, money stored or saved retains its value for many years.

(v) Measure of Value: Money as a measure of value allows prices to be fixed for goods and services. Therefore, money is used as a yardstick to measure and compare the worth of goods and serviced as well as occupation.

Qualities/Characteristics of Money

Good money has qualities or characteristics which distinguish it from other commodities used in ancient times. These qualities are:

(i) Acceptability: Anything to be used as money must be generally acceptable as a means of exchange and for settlement of debt. Money is generally acceptable because it is widely used and backed up by law.

(ii) Divisibility: Money must be divisible into smaller units, e.g. N10, N20, N50 etc. This will enable payments to be made in small amounts of money as desired.

(iii) Stability: The value of money must be stable. The stability of its value will help business to be predictable and encourage lending and borrowing of money.

(iv) Recognisability: Money must be easily recognized and identified by the totality of the people in the society. It must not be easily counterfeited

(v) Durability: For money to be stored for a long time, it must be able to last long .It must also be able to stand the test of time. For example, grains, livestock used in ancient times could decay after a long time. On the other hand, coins and bank notes can be withdrawn and new ones issued.

(vi) Portability: Anything to be called money must be easy to carry about. The portability of money makes local and foreign trade easy. For instance, if money were bulky, people will be discouraged from carrying them about.

(vii) Relative Scarcity: For money to maintain its worth, it has to be in limited supply. However, it should not be too scarce else people will not have money to buy goods thereby making money too valuable to be used in exchange for small items.

(viii) Homogeneity: This means that anything regarded as money should be the same within the restricted area where it is used. In this case, heterogeneity will give rise to problems of acceptability.

EVALUATION

- State five functions of money.

- Identify five characteristics of money.

Forms/Types of Money

The following objects are used as money at the present time.

(i) Coins: Coins are made of metals like copper, gold, silver etc. coins which are issued by the government or its agent are in two types. Standard coins and token coins. Standard coins contain the full face value of the metal while token coins have a face value that is usually higher than the value of the metal. Token coins are made of bronze and copper. Nigeria coins are token coins

(i) Paper money/bank notes: They are slips of paper or currencies issued by the central bank. Bank notes or paper money have no material value but have legal backing which makes them generally acceptable in exchange for the value of the amount indicated on them. Bank notes are also called fiat money, paper money, or representative money. Some paper money are backed up by gold while others which are not are called “fiduciary issue”. This is also called inconvertible paper money.

(ii) Near money: Near money consists of government securities that are close substitutes for money but are not legal tender. It is convertible money. Short and long term government securities have a guarantee which is redeemable by government at short notice.

(iii) Negotiable instruments: These are money order, postal orders, cheques, bills of exchange, bank draft etc. that are used in commercial transactions. The instruments authorize the bearer to collect cash or other item of value to the amount specified on the instrument.

(iv) Token money: Token money is partial money that is temporarily accepted within the confinement of a place. Examples of tokens include luncheon vouchers, fuel vouchers, value coupons or cards, tickets etc.

Read our disclaimer.

AD: Take Free online baptism course: Preachi.com